Term Life Insurance Quote of the Day

America's favorite term life insurance agency. Save when you compare quotes online

It’s true. This short, cute video sums it all up very nicely.

One of the most important tips comes at the very end, though. So let me call it out here: Comparison shop!

This so important because over the course of a typical 20 year term policy, saving even a few dollars per month can really add up!

QualityTermLife offers term life insurance quotes from dozens of top insurance companies, ensuring that you will get the best price.

Originally posted on Vimeo.

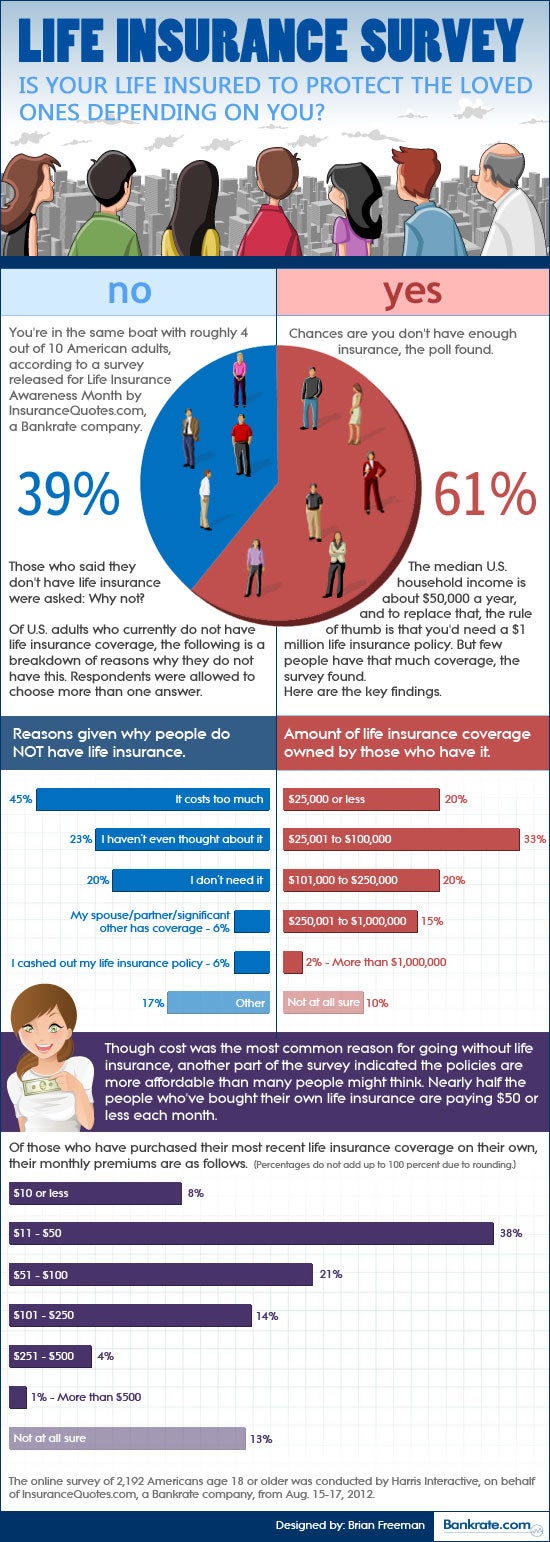

The infographic visualizes the fact that although 70% Americans do not have life insurance, 93% of them believe it is important to have it.

Why? At the very least, life insurance can help offset the costs of a funeral, which nowadays averages $20,000. Most importantly, it can replace the income of the primary breadwinner. It is recommended that coverage be somewhere in the neighborhood of 10 to 20 times gross income to provide financial security.

The cost of life insurance depends on the coverage amount, and the age and health of the insured. Life events like marriage, starting a family, or buying a home are all typical reasons that prompt people to buy a life insurance policy.

Life Insurance is a tiny investment to protect yourself and your loved ones in case of an emergency. Right now, rates are the lowest they have been in decades. If you don’t have this important investment in protecting the future of your home and family. Look into getting it, today. QualityTermLife let’s you compare term life insurance quotes online from dozens of the top insurers.

Source: Fidelity Life Insurance

What is the best type? How much should you purchase? Life insurance as a feature of a solid financial plan is a critical because it reduces risk, like the possibility that your family won’t have enough money if something were to happen to the income earner or care-giver.

Well, if you don’t have dependents, you probably don’t need life insurance. But, if you own a home, have children or others who depend on you, have a taxable estate or wish to leave money to charity, then life insurance can serve to protect your loved ones and the legacy you care about.

There are other types, but term life is what most people need. Important factors to consider are the length of the insurance (the term), the face amount (the amount your beneficiaries receive if you die) and the premium (how much the policy costs). Term is the most straight-foward form of life insurance (i.e. no investment features). And it is by far the most inexpensive. The way it works is that you pay the monthly or annual premium and, if the insured person dies during the term (time of coverage), the insurance company pays the beneficiary the face amount of the policy.

Beyond the need for a death benefit, there is whole life insurance. Unlike term life, it pays whether you die sooner or later. Instead of covering you for a temporary period (10, 20, or 30 years), so that you can take care of a mortgage or raising children, permanent insurance guarantees to pay a benefit whenever you die – even if you live past 100.

One common reason for owning whole life insurance is owning a taxable estate that can result in a considerable estate tax. In that case, death also provides the payout life insurance to cover the expense. You may also wish to bequeath money to a charity, which you can name as the beneficiary on the policy.

The types of things you should consider, include:

Shop with and purchase only from an independent broker – like Quality Term Life. An independent broker can show you competitive quotes from dozens of insurers. Whereas a captive agent can only sell insurance offered by one company,

As a side note, many people seem to think they can’t get life insurance because of a pre-existing medical condition or disease. But in almost all cases, there are affordable options available. Quality Term Life advisors can help you find the best insurance for your situation. Just give them a call.

If you don’t have life insurance now, be sure to add it to your overall financial plan. It is a critical risk management asset. But more importantly, it protects your loved ones’ future, giving you peace of mind – which is priceless.

Short answer: No. The reality is that the overwhelming majority of children don’t need life insurance.

While the advertisements for insuring children may appeal to your emotions, the financial fact is that a loss of a child will will actually remove a major commitment. That may sound harsh, but life insurance is for helping with the financial repurcussions of a death, and it simply costs much less not having a child than having one.

Is children’s life insurance cheap? Sure, but that is because it is rare for children to die. The sales agent will give you a great pitch about how low the cost is, but if you figure the return on investing all those years of premiums into a Roth IRA, or 529 college account, you’ll see that it’s really not such a great deal at all. There are far better investment vehicles that will help you and your child.

The main reason for life insurance is to provide financial security to the family in the event that an income earner dies. So, unless your child is a child movie or rock star, there is probably no reason for you to buy children’s insurance.

On the other hand, far too many parents who are considering children’s insurance are underinsured themselves or simply aren’t insured at all. Your children are much more at risk of losing you, than you are of losing them.

Visit an online insurance website with a good needs calculator. After you figure out how much insurance you should have, use the quote engine to see just how affordable an adequate amount of insurance is.

Quality Term Life’s website features an easy to use needs calculator, and you can compare rates from dozens of leading term life insurance companies to get the best price.

Live life – with confidence

Protecting the financial future of children is something concerns all parents. But in the case of a parent with a special needs child, planning for a future when you may no longer be around can extend into your child’s adulthood.

Protecting the financial future of children is something concerns all parents. But in the case of a parent with a special needs child, planning for a future when you may no longer be around can extend into your child’s adulthood.

In this case, the typical term life insurance policy – with a cover equal to 8-10 times annual income plus debt obligations – won’t be sufficient. On average, children are dependent on parents financially for up to 25 years. But special children may be financially dependent for many years beyond that – with the very real likelihood that their parents will not be around when they are still dependent.

The amount and term (years) of the life coverage a parent in this situation should have requires that this longer view be taken into consideration. Of course, how much more coverage you need and for how much longer depends on your individual financial circumstances and on how independent your child is likely to be.

Fortunately, today, many special children can live quite independently, some even financially so. As a parent, you work hard to give your special someone as much freedom as possible. With the right life insurance, you can help to continue it long after you are gone.

For help on the details, use our needs calculator and quote engine, and then contact one of our insurance experts consult a Quality Term Life insurance expert who will help you find the most affordable policy.

Live life – with confidence

Did you know that life insurers pay on average $1.5 billion daily? No. That figure is not a typo. Compare this with $1.9 billion from Social Security and you see that this is a payout of major proportions!

Life insurance is relied on by 75 million American families to protect their financial security.

Most quote forms on “instant life insurance quotes” websites require you to enter your personal contact information (i.e email and phone) before you can see their quotes. The obvious reason is so that the company’s agents can follow-up with a sales call if you don’t follow through with applying for the quote.

But there is another reason, with far worse consequences to you. Half of these sites don’t actually sell life insurance. Instead, they make money purely off collecting your contact information. These sites, known as lead aggregators, collect your personal information as well as the details of your quote and sell it to brokers and agent who will then put you onto their sales target contact lists. Sure, you’ll get your free quote, but it will come packaged in a high-pressure sales pitch – and will likely cost you more because the quote you get will be the one that makes the sales agent the most money!

If you select 3 firms at random ranked in the top 20 search engine results for “term life insurance quotes” and provide your contact information, here is what you can expect over the course of the next month:

Now, in those top 20 search results there was only one that offered anonymous life insurance quotes, where contact information wasn’t required first. Unfortunately, it may take some clicking around to find a site like this – but it is well worth the time.

So to keep your personal contact information safe, follow these steps when looking online for life insurance quotes.

For an accurate quote, you will need to input date of birth, gender and state of rate calculation purposes, but you are never asked to provide your name, phone number, address, or email to just to get your quotes.

What stands out is the reason for the lack of insurance: People think it costs to much.

What we really have then is an information gap because, according to the survey, life insurance is not expensive. Most people pay less than $50/month. If you take a look at our Quote Engine, $40/month is going to buy a middle-aged consumer hundreds of thousands of dollars of coverage.

Source: Bankrate.com

The basic premise of life insurance is to provide a financial cushion for your dependents. The question then becomes, how much of a cushion do you need?

There are a variety of methods and formulas you can use to determine how much life insurance coverage is appropriate for you and your family.

You can look at it from two perspectives: the immediate need and the long-term need.

This refers to the money that will be needed to cover funeral expenses and help your family get through the initial months immediately following your death. This is the time when everyone is still reeling from the shock and trying to figure out how best to get on with their lives. Life insurance can provide a quick financial buffer to help families through this transitional time period.

This refers to the economic needs of the family over a longer time horizon. How much will be needed to cover the family’s annual living expenses? This is often broken down into two categories — one for the living expenses while the children are still at home, and the second for the living expenses for the surviving spouse after the children have moved out: including how much is needed to pay for college costs for the children, and how much to pay off the mortgage?

This works out differently for every family based upon their unique needs and circumstances. For instance, single-income families dependent on the income of a single wage-earner will have a different set of needs than a two-income family. Additionally, if there is a stay-at-home parent, it is important to calculate the economic impact if he or she were to die, such as the cost of child-care expenses and running the household.

There are a variety of calculators available on the Internet. These can be a great starting point, though I always think it is good idea to discuss your specific situation with a life insurance professional, such as the expert advisors at Quality Term Life Insurance.

Source: Laura Medigovich