Courtesy of LIMRA

Valentine’s Day brings thoughts of roses and chocolate, but have your clients thought about giving peace of mind? According to LIMRA research, 9 in 10 life insurance owners say that is what they get from purchasing life insurance.

LIMRA is joining Life Happens with its “Insure Your Love” campaign, which highlights the importance of protecting the ones you love through the purchase of life insurance.

More than half of American adults (57%) own some type of life insurance. Three in 10 consumers have life insurance coverage at work, while 4 in 10 have individual insurance.

The majority of Americans believe that most people need life insurance, and identify several reasons for owning it such as paying for final expenses (91%), replacing lost wages (66%), and leaving an inheritance (63%).

So, what prevents consumers from owning life insurance (or purchasing more)? The top three reasons: it is too expensive (63%), they have other financial priorities (61%), or they already have enough coverage (52%).

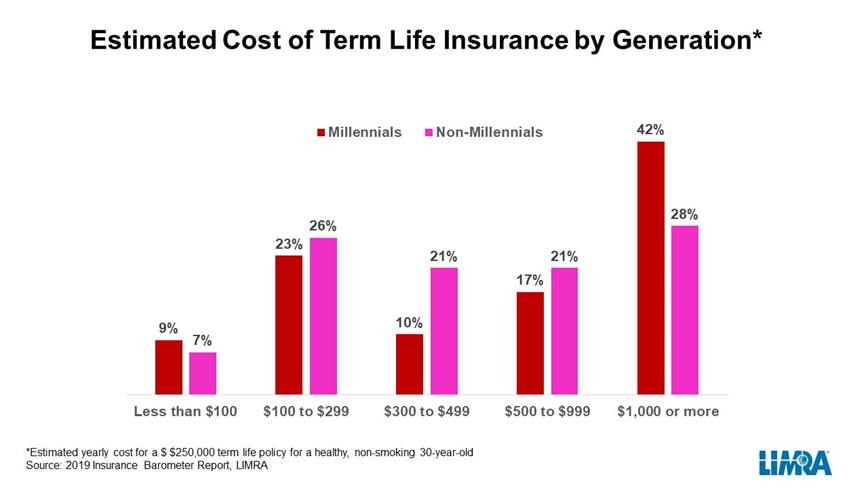

When it comes to cost, consumers generally overestimate the cost of owning life insurance. The Millennial generation, much more than Baby Boomers or Gen X, is likely to overestimate the price tag for term insurance.

In fact, in a recent LIMRA survey, only about a 1 in 4 consumers have a good idea of what a $250,000 term life policy would cost for a healthy, non-smoking 30-year-old (see chart). The actual cost for the policy is roughly $160 per year.