The global pandemic has Americans thinking about and buying life insurance.

Sales of U.S. life insurance policies increased 8% in the first six months of 2021, marking the largest year-over-year increase since 1983, according to LIMRA, an industry-funded research group.

“Following the record life insurance sales in the first quarter, most companies are reporting significant growth in premium and policy sales in the second quarter. Eight in 10 carriers reported positive premium growth including each of the top 10 carriers,” David Levenson, president and CEO of LIMRA, said in a statement.

Life Insurance Is On People’s Minds

Life insurance policies are at the top of consumers’ minds, with 36% of Americans saying they plan to buy life insurance this year, according to LIMRA.

“Covid-19 has raised consumers’ awareness about the importance of having life insurance,” Levenson said. “Nearly a third of consumers (31%) said they were more likely to purchase coverage due to the pandemic. This is so important because too many Americans live with a life insurance coverage gap, leaving their loved ones’ financial security at risk.”

Too many American families are not ready for an unexpected death, according to a survey of military members and civilians by USAA Life Insurance Co. In fact, Americans may be overconfident when it comes to financial preparedness.

Most survey respondents believe their family would be financially secure after they die. But when asked how long their family could afford basic living expenses if the primary breadwinner died, 40% say their family would not be able to meet financial obligations for more than a year.

“USAA recommends having enough life insurance to pay off all your debt and replace income for at least five years,” Brandon Carter, president of USAA Life Insurance Co., said in a statement.

Nearly half of Americans (47%) believe money is the most important thing to leave your family when you die. And 31% of Americans believe life insurance is the best way to pass down wealth in a family, according to USAA’s survey.

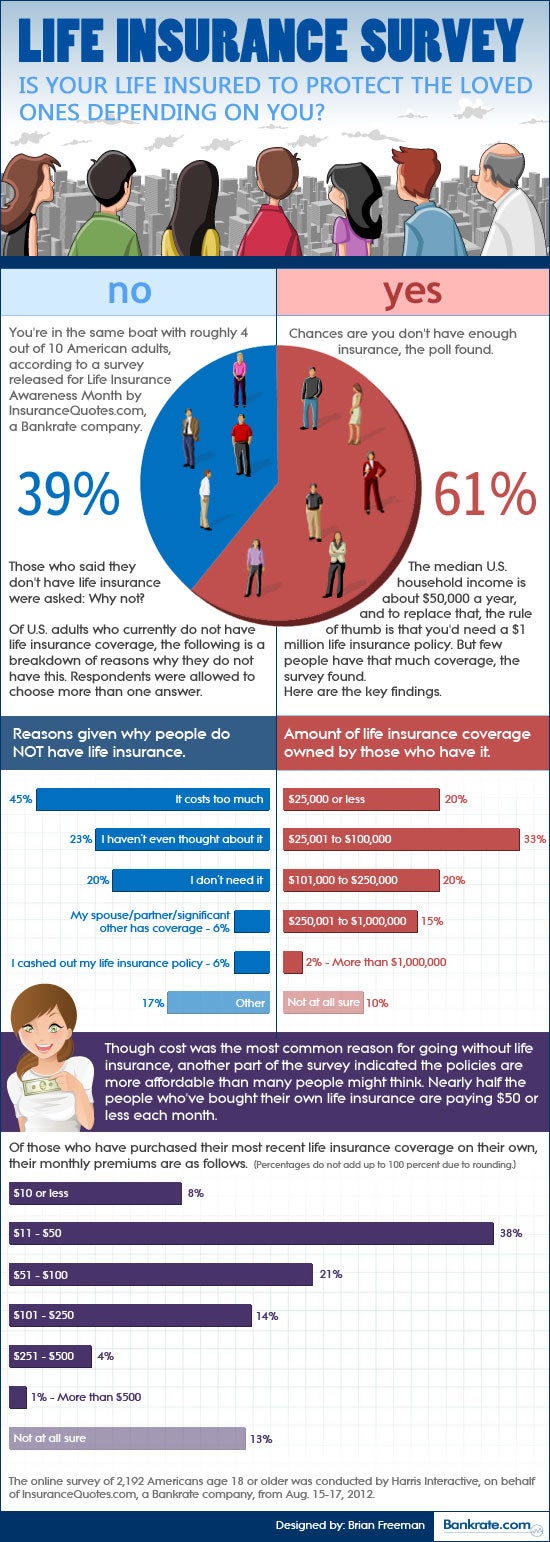

Less than half (46%) of Americans have no life insurance, according to USAA. And there may be a couple of reasons for this. Thirty percent of those surveyed said they believe it costs too much.

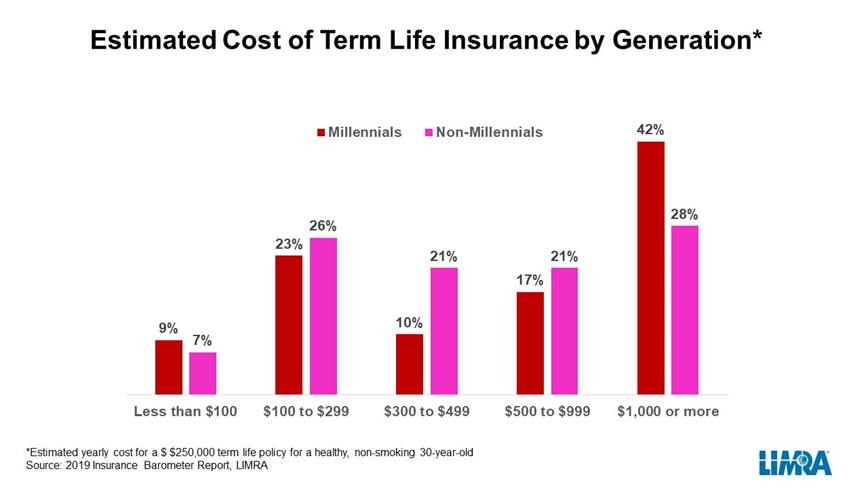

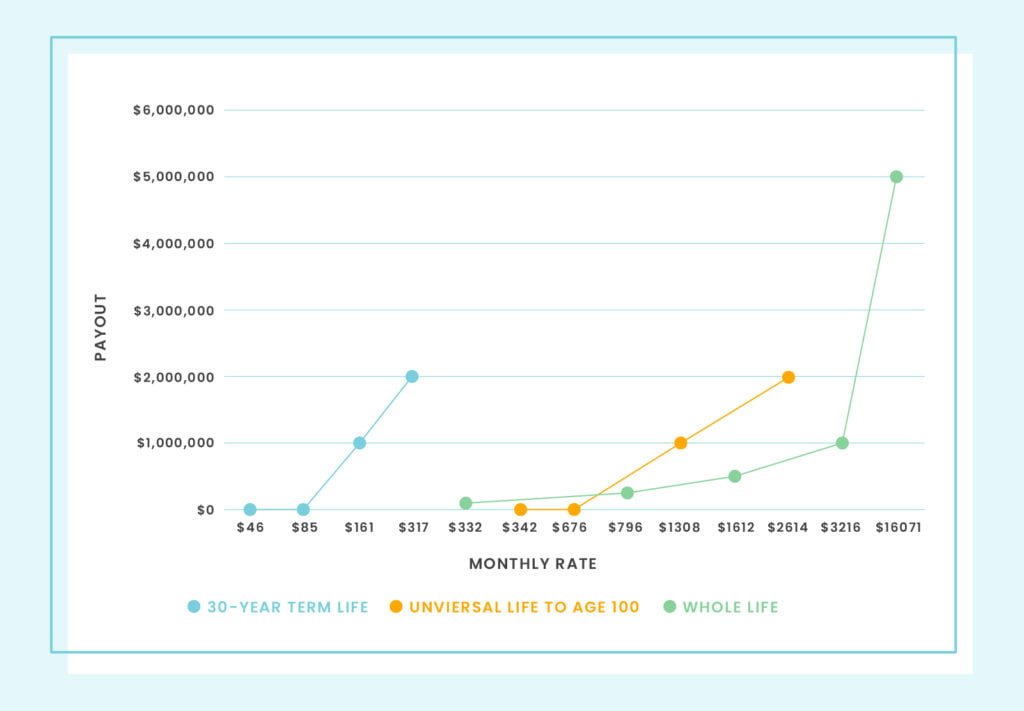

This is a tragic situation because life insurance is surprisingly affordable. The obvious solution to this misconception is to take a look at actual rates. Luckily, many websites , like QualityTermLife provide life insurance rate comparisons online.

Tips for Buying Life Insurance

Interested in buying a life insurance policy in 2021? Here are a few tips:

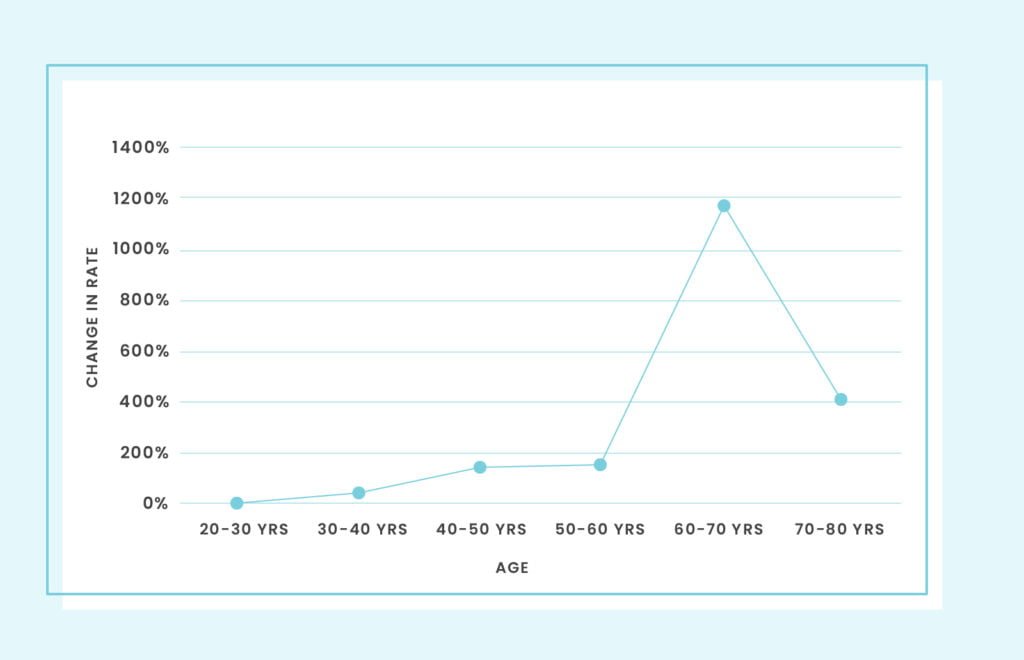

- Buy your life insurance policy when you are healthy and young and can lock in a lower rate.

- Having life insurance through your employer is almost always inadequate. Supplement it with an individual life insurance policy. This way you also maintain coverage when you switch jobs.

- Determine the amount you need by using an easy-to-use needs calculator.

- Comparison shopping can save hundreds of dollars each year on you life insurance. For example, you can compare rates from nearly 50 A-rated insurance companies getting free, online quotes at QualityTermLife’s website.

Protecting the financial future of children is something concerns all parents. But in the case of a parent with a special needs child, planning for a future when you may no longer be around can extend into your child’s adulthood.

Protecting the financial future of children is something concerns all parents. But in the case of a parent with a special needs child, planning for a future when you may no longer be around can extend into your child’s adulthood.