Life insurance is a crucial part of any solid financial plan, but 41% of Americans say they don’t have sufficient life insurance coverage. That’s why Life Happens created Life Insurance Awareness Month (LIAM) and why QualityTermLife strongly supports efforts to promote the benefits of life insurance during September and all year long. For agents and advisors, LIAM is the perfect time to meet with your clients to make sure their life insurance coverage meets their needs.

This year’s LIAM spokesperson is Roselyn Sánchez, actress, producer, proud Puerto Rican, and mother. She is featured on many of the LIAM promotional materials available from Life Happens.

“Let’s educate people about the importance of life insurance so they can make that easy decision for their family,” Sánchez says.

LIAM provides a great opportunity for everyone to shine a spotlight on life insurance products and work towards improving those statistics. Many common consumer objections to purchasing life insurance (or purchasing enough) are either inaccurate or easily surmountable. These include:

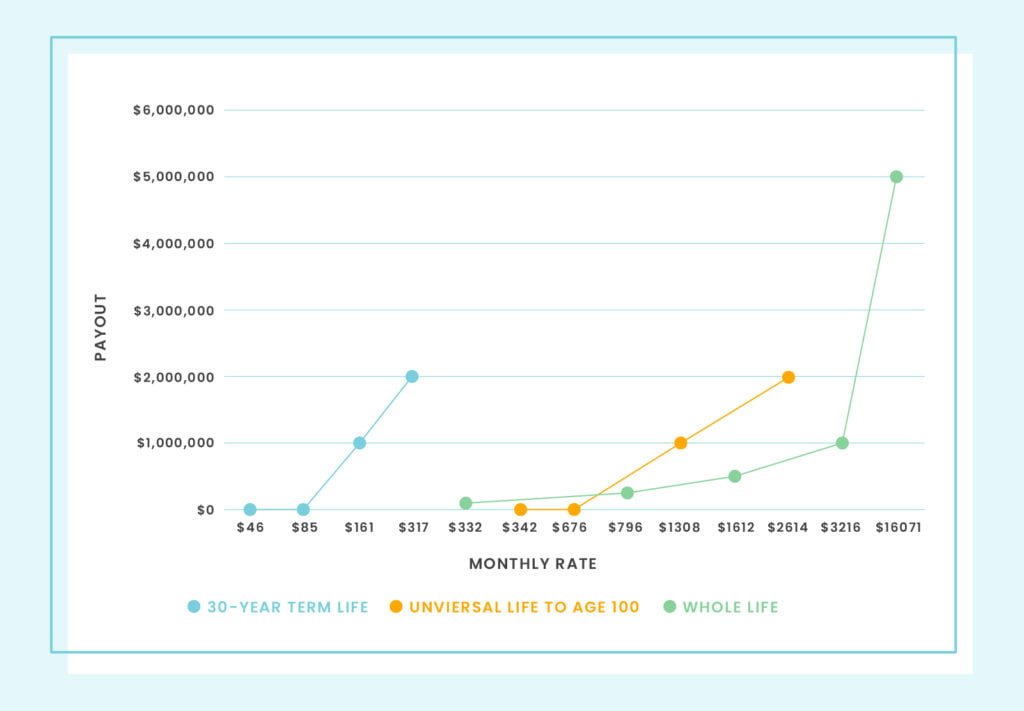

- It’s too expensive. You can see for yourself using an online life insurance quote engine just how affordable life insurance can be. It’s easy to shop and compare prices from dozens of A-rated companies for any budget.

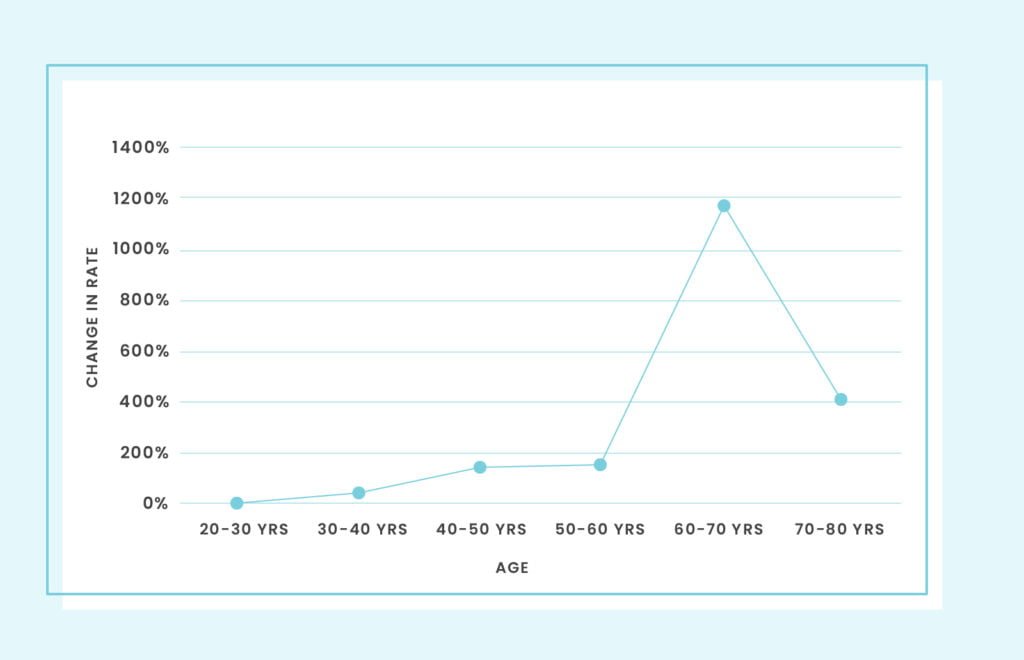

- They will buy it later. Purchasing life insurance early is often a good decision. Young and healthy people are generally able to get less expensive coverage. LIMRA found that nearly 40% of people who have purchased life insurance wish they had done so earlier.

- They don’t understand the products. This is a fault of life insurance agents who confuse customer with options, like whole life and universal life, forms of permanent insurance. They are complicated and confusing. The truth is that Term Life insurance the right product for the vast majority of people: anyone with dependents, debt and minimal savings. It is straightforward to understand and easy to buy.

- They are covered through work. While workplace plans are often an excellent benefit, most provide insufficient coverage to meet a family’s needs. Nice to have, but workplace plans are not intended to provide long-term financial protection for an employee’s family. Also, the plan ends when the employee should lose their job, get a new one, or retire.

- It’s depressing. Many people are uncomfortable talking about providing for their families after they are gone. To the contrary, knowing that they are providing financial security for their loved ones puts consumers at ease. It is the responsible, adult thing to do.

- They don’t want to take a medical exam. Don’t worry. It is a very basic exam, quick and easy. A nurse will come to you to take your medical history, physical measurements, and diagnostic specimens. The insurance company pays the cost.

While life insurance is important every day of the year, QualityTermLife is proud to acknowledge September as Life Insurance Awareness Month, promoting life insurance for the benefit of families across the United States.

by David Chen, Guest Blogger

by David Chen, Guest Blogger