How Much Does A Term Life Insurance Policy Cost?

Do You Know The Average Cost Of A Life Insurance Policy?

According to MarketWatch, 40% of Americans do not have a life insurance policy and, for many years now, the majority of those who don’t have life insurance choose not to because they think it’s too expensive. LifeHappens.org has found that people assume that life insurance is up to 3x more expensive than it really is!

September is life insurance month, so here is our guide to understanding the true costs of life insurance.

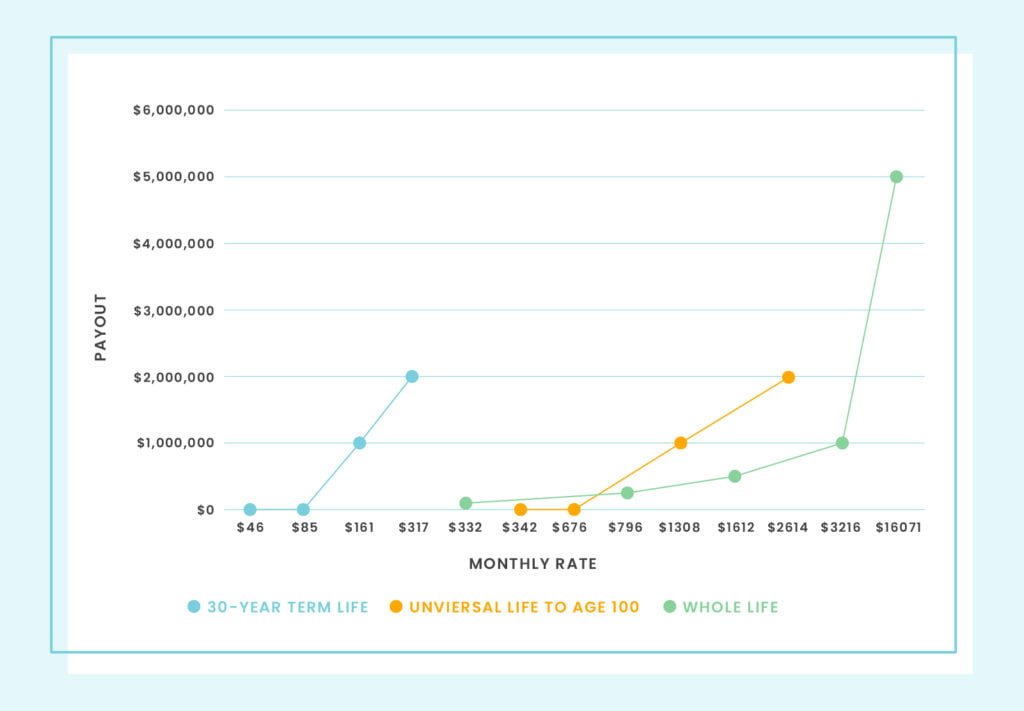

Actual rate from QualityTermLife.com’s quoting system:

- A 20-year-old man can get a $250,000, 30-year term life insurance policy for the price of 3 gallons of gas in California (about $13/month).

- A 40-year-old woman could get $1 million of 20-year term life coverage for the cost of 12 Grande Starbucks lattes (about $45/month).

- A 55-year-old woman could get $200,000 of 15-year term life coverage for the price of six cocktails (about $32 /month).

Experts quotes for finding the right life insurance policy:

When choosing a coverage amount, it’s best to start with what you want to accomplish. Think about what needs your family will have if you were to pass away unexpectedly. A 30-year-old with a newborn will have different needs than a 60-year-old who is thinking of retiring soon. Use a detailed online needs calculator to determine the amount you should get.

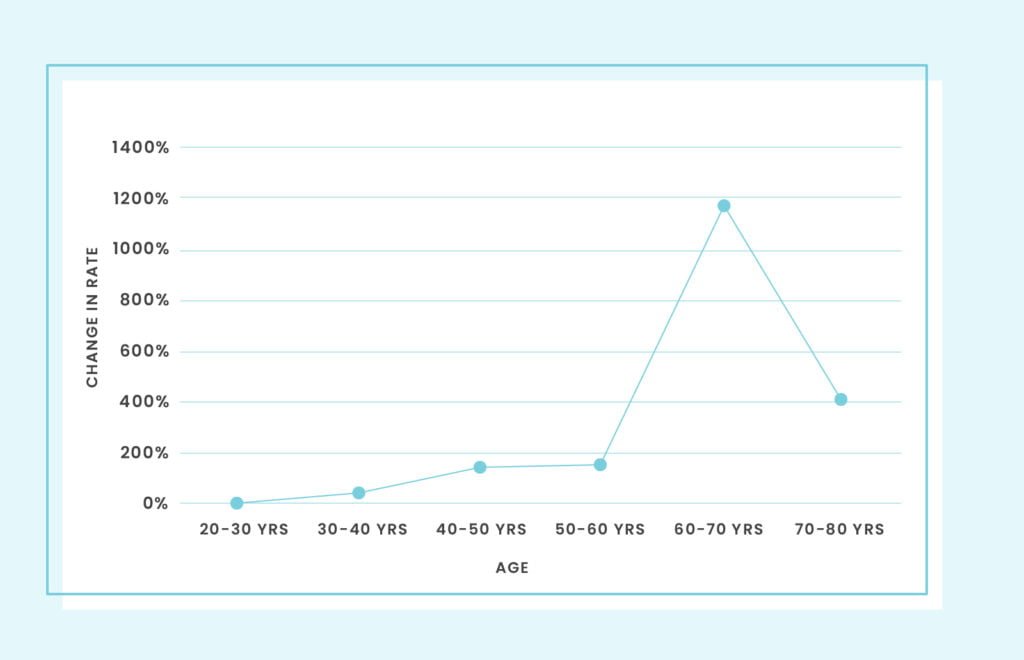

There are two main reasons to get a life insurance policy as soon as you have the need. First, rates are based mostly on age and increase as you get older. Second, life is unpredictable. Taking pressure of worrying about how loved ones will cover the mortgage or put food on the table without you will help you sleep better at night.

Infographic with more info below