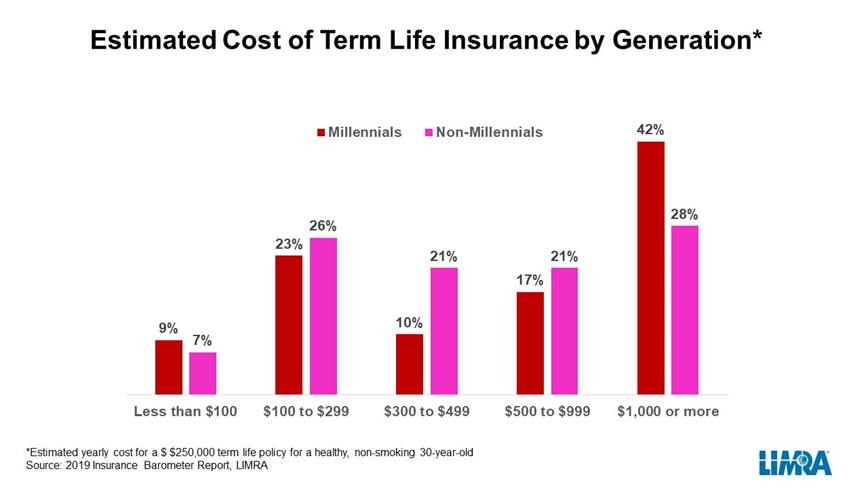

Consumers think it’s too expensive and too complicated to buy – but it actually isn’t.

The percentage of Americans who have a life insurance policy is declining, according to a new study by J.D. Power. Its 2020 U.S. Life Insurance New Business Study found that the decline is largely driven by consumers under the age of 45, many of whom consider life insurance unnecessary, too expensive, or too complicated to purchase.1

KEY TAKEAWAYS

- The percentage of Americans with a life insurance policy is declining, according to a new J.D. Power study.

- The decline is largely driven by people under age 45.

- Many consumers consider life insurance unnecessary, too expensive, or too complicated.

Life Insurance Remains a Mystery to Many

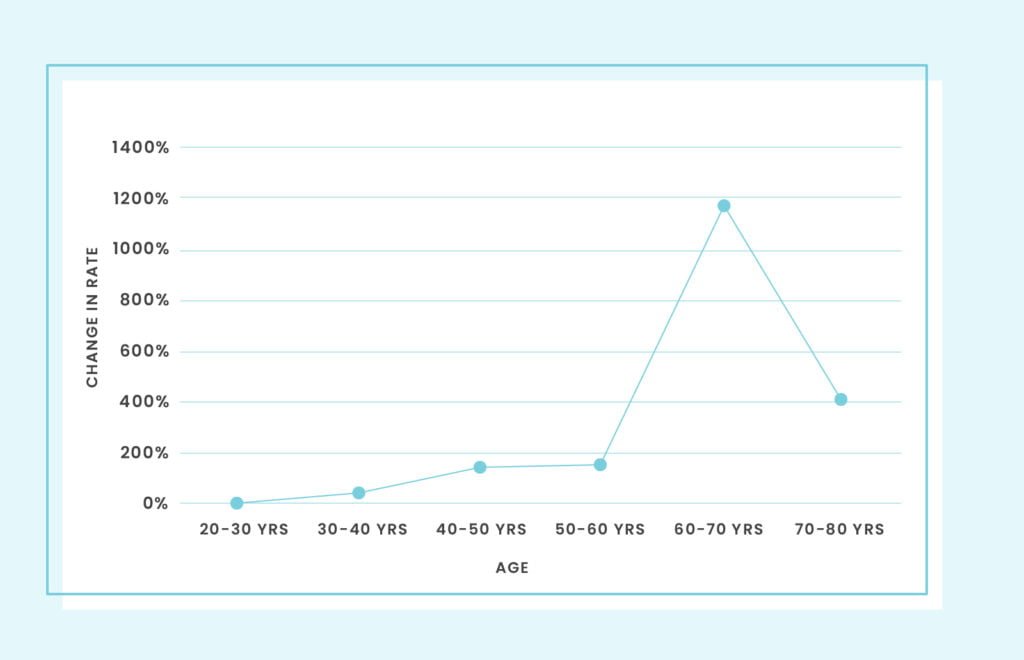

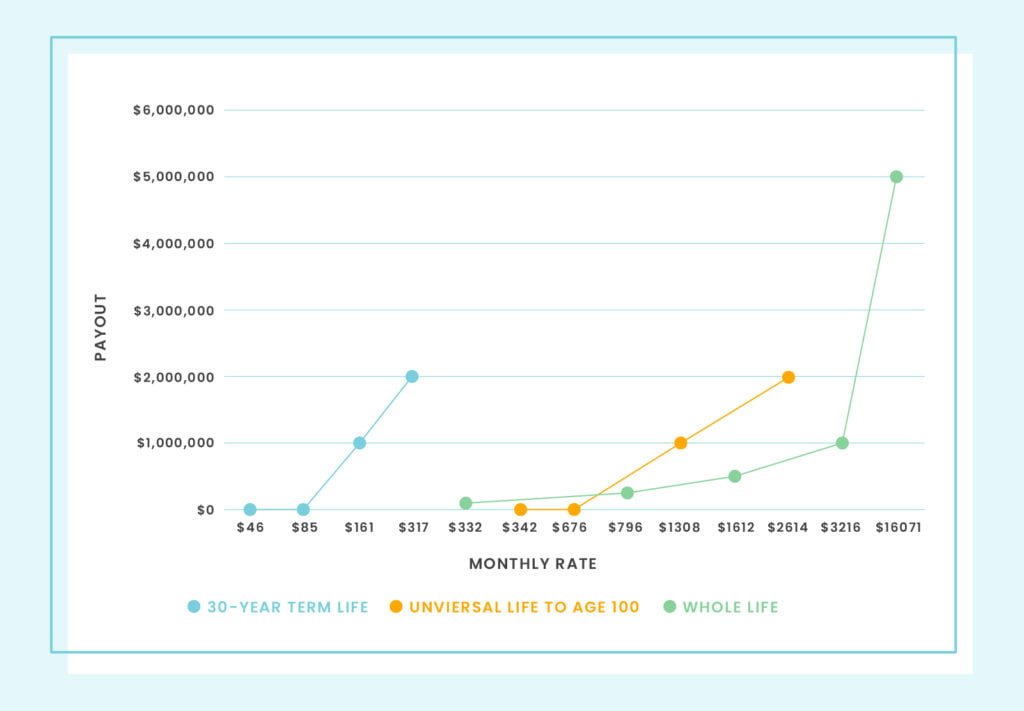

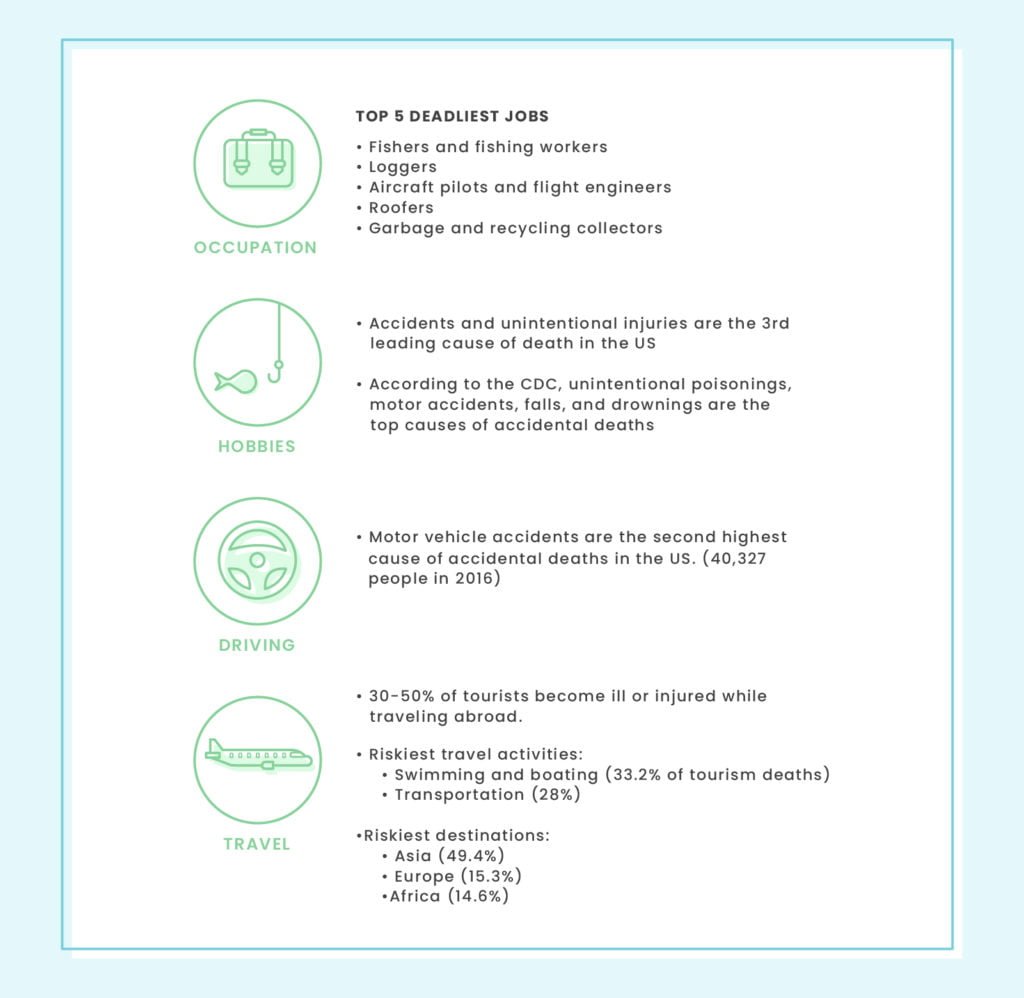

Depending on the type of policy, life insurance can be expensive and complicated, as study respondents said. However, term insurance, which is generally the best option for most consumers, is cheap and relatively simple.

Unfortunately, the study found that the workings and benefits of life insurance policies still remain mysterious to consumers, which decreases the chances of them buying one. That can leave individuals and families financially devastated if a loved one passes away.

Life insurance professionals, including agents, advisors, and carriers, can help dispel some of the myths of life insurance and highlight the benefits, according to the study.

Specifically, J.D. Power recommends that insurance professionals make sure that prospects understand coverages and costs, and keep them up to date on the status of their application for insurance once it’s been submitted.

Other Findings of the J.D. Power Study

Among the study’s other findings:

- Just 44% of consumers shop around and compare life insurance quotes from multiple insurers.

- Roughly three-fourths of consumers who purchased a policy said they picked it because it had the lowest price.

Reference: Investopedia

QualityTermLife Has You Covered

Life insurance is a critical financial tool. Amazing that a primary reason consumers say they don’t purchase more life insurance is because it’s too expensive! It is one of the most reasonable and worthwhile investments you can make.

The obvious solution to this misconception is to make life check out actual rates. In fact, many websites provide life insurance rate comparisons online.

You can find instant, term life quotes from dozens of A-rated life insurance carriers at QualityTermLife.com.

Check it out now to see for yourself how inexpensive life insurance can be.

Reference: Investopedia

by David Chen, Guest Blogger

by David Chen, Guest Blogger